What is Payment API integration?

In today's digital age, the seamless flow of financial transactions has become crucial for businesses worldwide. With the rise of online commerce, mobile payments, and the need for streamlined financial operations, API integration has emerged as a fundamental tool for facilitating secure and efficient payment processing.

In this article, we will delve into the concept of API integration in payment systems, exploring its key components, benefits, its significance in digital transactions, and the types of companies that need payment API integrations.

What is API integration in payment systems?

API integration, or Application Programming Interface integration, refers to the process of connecting different software applications, systems, or platforms by leveraging APIs.

In the context of payment systems, API integration enables the seamless exchange of data and instructions between a payment gateway or processor and the software or platform that initiates or receives the payment.

Key Components of API Integration in payments

Payment gateway

The payment gateway serves as the intermediary between the customer, the merchant, and the financial institution. It facilitates the authorization, processing, and settlement of transactions. Through API integration, the payment gateway connects with external software or platforms to enable smooth payment processing.

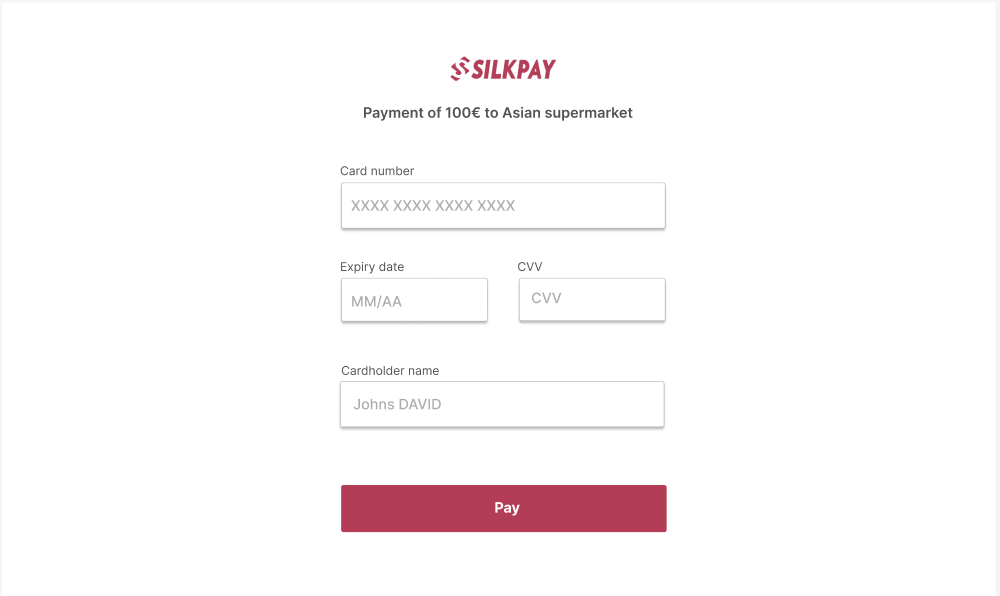

Silkpay's API supports multiple payment methods, including credit cards, digital wallets, and alternative payment options. This versatility enables you to cater to a wide range of customer preferences, enhancing convenience and increasing conversion rates.

APIs

APIs are the building blocks of API integration. They are sets of rules and protocols that enable different software applications to communicate with each other. Payment APIs allow businesses to interact with payment gateways, retrieve transaction details, initiate payments, and receive real-time updates on transaction status.

Data security

API integration in payment systems prioritizes data security. The transmission of sensitive customer information, such as credit card details, must be protected. Payment APIs utilize encryption and tokenization techniques to ensure secure data transmission and storage, minimizing the risk of fraud and unauthorized access.

Why is API integration important for business?

Here are some benefits of API Integration in payment systems:

1.Seamless user experience

API integration streamlines the payment process by eliminating the need for manual data entry, resulting in a smoother user experience. It enables customers to make payments directly on a merchant's website or application without being redirected to external payment platforms.

2.Real-time transaction updates

Payment APIs provide instant notifications and updates on the status of transactions, enabling businesses to track and manage payments efficiently. This real-time information helps prevent delays, resolve issues promptly, and enhance customer satisfaction.

3.Customization and scalability

API integration allows businesses to customize the payment experience according to their brand's requirements. It offers flexibility in terms of design, functionality, and user interface. Additionally, APIs support scalability, enabling businesses to handle increasing transaction volumes as their operations grow.

4.Integration with third-party services

API integration in payment systems enables seamless integration with other business-critical services such as accounting software, customer relationship management (CRM) systems, or inventory management tools. This integration enhances overall operational efficiency and provides businesses with a holistic view of their financial transactions.

5.Enhanced security

Payment APIs implement robust security measures, such as tokenization and encryption, to protect sensitive customer data. This ensures compliance with industry standards, such as the Payment Card Industry Data Security Standard (PCI DSS), and safeguards against potential breaches or fraudulent activities.

What kind of business needs API integration in payment systems?

API integration in payment systems is beneficial for a wide range of businesses across various industries. Here are some examples of businesses that can greatly benefit from API integration:

1.E-commerce platforms

Online retailers and e-commerce platforms heavily rely on API integration to enable secure and seamless payment transactions.

API integration allows them to connect their platforms with payment gateways, facilitating real-time payment processing, order fulfillment, and inventory management.

2.Subscription-based services

Businesses offering subscription-based services, such as streaming platforms, software-as-a-service (SaaS) providers, or membership-based organizations, can utilize API integration to automate recurring payments, manage subscription plans, and handle billing cycles effectively.

3.Mobile applications

Mobile apps often require in-app purchases or mobile payment capabilities.

API integration enables mobile app developers to integrate payment gateways seamlessly, providing users with a convenient and secure payment experience directly within the app.

4.Marketplace platforms

Marketplaces that connect buyers and sellers, such as online marketplaces for goods or services, can leverage API integration to facilitate secure transactions between multiple parties.

API integration allows for seamless payment processing, commission management, and order tracking within the marketplace ecosystem.

5.Travel and hospitality industry

Businesses in the travel and hospitality industry, including airlines, hotels, and online travel agencies, can benefit from API integration to streamline payment processes for bookings, reservations, and online ticketing.

Integration with payment gateways enables secure payment transactions and ensures a smooth customer experience.

6.Financial institutions

Banks, credit card companies, and other financial institutions require API integration to connect their core banking systems with payment processors, allowing for seamless fund transfers, payment reconciliations, and real-time transaction updates.

7.SaaS providers

Software-as-a-Service (SaaS) providers often incorporate API integration in their platforms to enable subscription management, billing automation, and secure payment processing for their customers.

8.Non-profit organizations

Non-profit organizations can utilize API integration to facilitate online donations, enabling donors to contribute securely through various payment methods. Integration with payment gateways allows for real-time tracking of donations and automated acknowledgment processes.

9.Online gaming

Online gaming platforms websites often require real-time payment processing and secure transactions.

API integration enables seamless integration with payment gateways, allowing players to make deposits, withdraw winnings, and participate in transactions securely.

10.Educational institutions

Schools, colleges, and e-learning platforms can leverage API integration to streamline payment processes for tuition fees, course enrollments, and educational resource purchases.

Integration with payment systems allows for secure and efficient financial transactions within the educational ecosystem.

Conclusion

API integration plays a vital role in transforming the payment landscape, simplifying transactions, and enhancing user experiences. By connecting payment gateways with various software applications and platforms, businesses can streamline their payment processes, improve operational efficiency, and provide a secure environment for customers to transact.

As digital commerce continues to evolve, API integration will remain a key enabler for businesses to stay competitive and adapt to changing consumer preferences. Embracing API integration in payment systems empowers organizations to deliver seamless and secure transactions while creating a foundation for future growth in the digital economy.

About the author: Silkpay

Based in Paris, Silkpay provides omnichannel and secure payment solutions to help physical stores and e-commerce in Europe accept more than 30 of the world's most popular payment methods: Visa, Mastercard, CB, UnionPay, Alipay+, WeChat Pay as well as Asia-Pacific’s major e-wallets.

Silkpay is a winner of the LVMH Innovation Award. The company was also selected as a finalist for the "Money 20/20" Best Startup and in the "MPE Berlin” Startup Awards. Silkpay also won the "Best Fintech" awards from Capgemini and BPCE.

Silkpay helps merchants deliver the smoothest payment experience to their customers. We are a talented and international team driven by a single goal: to improve the customer experience and make payments simple and secure.